From Analyst to Associate: Mock Interviews for Career Growth in Finance

Table of Contents

- Introduction

- Understanding the Analyst to Associate Transition

- The Role of Mock Interviews in Career Advancement

- Key Components of Effective Mock Interviews

- Benefits of Mock Interviews

- Implementing Mock Interviews in Your Preparation

- Common Challenges and How to Overcome Them

- Real-Life Success Stories

- Conclusion

Moving up from an analyst position to the associate level is often seen as the first major leap in a finance career. This advancement involves developing new skills, understanding more complex expectations, and refining your strategic thinking, communication, and leadership abilities. One approach that stands out for its practical effectiveness is mock interviews for preparation.

Mock interviews go far beyond the traditional Q&A format. They mirror the pressure and format of real interviews, while also offering meaningful feedback that can be used for improvement. Reliable experts at https://www.cookd.ai make this process even more accessible, providing tailored mock interview sessions for finance professionals that simulate real-world scenarios. Incorporating mock interviews into your preparation strategy enhances your understanding of potential interview topics and helps tailor your responses for various audiences in finance careers. This approach fosters a growth mindset, boosting self-awareness and confidence for interviews. Regular participation in mock sessions equips candidates with essential skills such as quick thinking, effective communication, and storytelling, making them more adaptable at responding to unexpected challenges during interviews.

Understanding the Analyst to Associate Transition

The transition from analyst to associate is marked by a clear evolution in roles. While analysts are relied on for their meticulous attention to detail and their ability to implement instructions precisely, associates are decision-makers and project managers. Associates not only handle more complex financial modeling, client presentations, and strategic analysis but also mentor newer team members and manage client relationships. This step up demands not just technical proficiency, but also the ability to lead, delegate, and resolve problems swiftly.

The Role of Mock Interviews in Career Advancement

Mock interviews play a pivotal role in career advancement for finance professionals. They bridge the gap between knowing your material and effectively communicating it under pressure. By recreating the structure and rigor of a true associate-level interview, mock sessions train candidates to think critically and respond confidently in unfamiliar situations. Participants receive immediate feedback that highlights both technical strengths and key areas for development from core financial competencies to leadership and communication skills.

Key Components of Effective Mock Interviews

- Realistic Scenarios: Effective mock interviews mimic the exact framework of the real thing, including time constraints, technical questions, and behavioral or situational prompts. Practicing in a setting that feels genuine is crucial for performance improvement.

- Constructive Feedback: Immediate, detailed feedback helps candidates identify and address weaknesses. Critiques should focus on specific skills, such as technical analysis, clarity of argument, or professional demeanor.

- Repetition: Practicing multiple sessions, not just one, reinforces learning, makes responses more agile, and significantly increases comfort with the interview process.

Benefits of Mock Interviews

- Enhanced Communication Skills: Candidates learn to articulate complex financial concepts in simple, persuasive language, preparing them to engage effectively with colleagues, clients, and interviewers alike.

- Improved Technical Proficiency: Regular mock sessions keep both foundational and advanced finance knowledge sharp, enabling candidates to respond promptly to technical questions.

- Increased Confidence: Familiarity with interview formats reduces stress, increases poise, and helps candidates remain calm in high-pressure evaluation environments.

Implementing Mock Interviews in Your Preparation

- Identify Areas of Improvement: Take an honest inventory of your skills, both technical and soft. Focus your mock interviews on these areas for targeted development.

- Utilize Professional Services: Online coaching platforms and career advancement services can pair you with experienced industry professionals for realistic mock interview sessions tailored to your goals.

- Seek Peer Feedback: Practicing with colleagues or mentors offers different perspectives and uncovers blind spots, making you a more versatile candidate.

Common Challenges and How to Overcome Them

Many candidates struggle with nerves and with presenting their experiences clearly. Overcoming interview anxiety requires consistent repetition and exposure to interview-style questioning. Practicing mindfulness, visualization, and controlled breathing can help regulate nerves. Asking for detailed, constructive feedback from coaches or peers helps shape your responses for clarity and impact. Over time, this cycle of practice and revision transforms weaknesses into strengths, improving both skills and confidence.

Real-Life Success Stories

There are numerous accounts of finance professionals who successfully leveraged mock interviews to secure associate roles. For instance, a 2025 study revealed that students and early-career professionals who practiced with mock interviews reported feeling more prepared and confident during real interviews, leading to higher conversion rates from application to job offer.

Conclusion

Progressing from analyst to associate in the finance industry is both challenging and rewarding. Integrating mock interviews into your interview preparation strategy is a proven way to refine your skills, build confidence, and approach the associate role with the readiness it demands. By committing to realistic practice, seeking constructive feedback, and embracing continuous improvement, you set yourself up for success at every stage of your financial career journey.

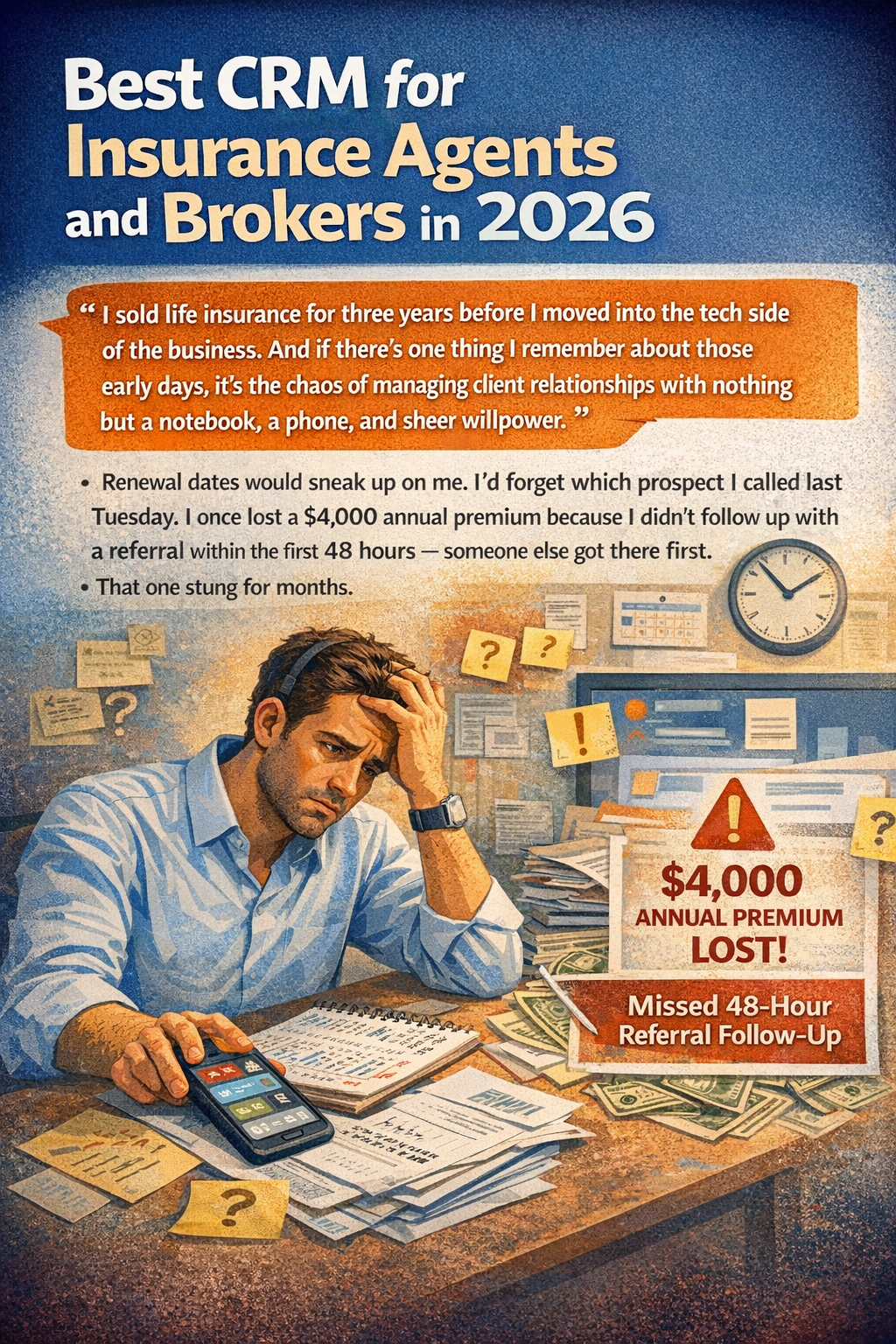

Also Read: Best CRM for Insurance Agents and Brokers in 2026