Best CRM for Insurance Agents and Brokers in 2026

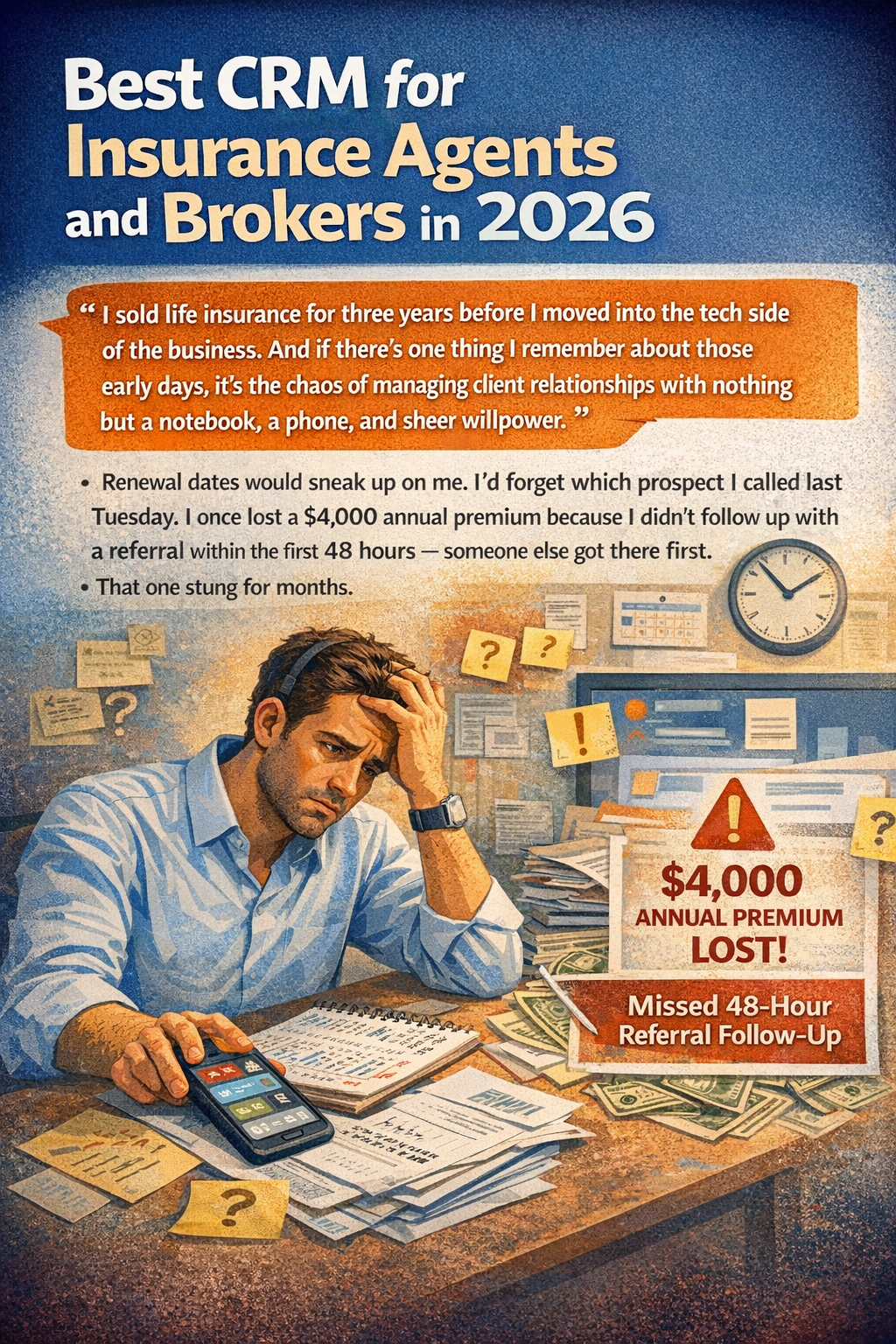

I sold life insurance for three years before I moved into the tech side of the business. And if there’s one thing I remember about those early days, it’s the chaos of managing client relationships with nothing but a notebook, a phone, and sheer willpower.

Renewal dates would sneak up on me. I’d forget which prospect I called last Tuesday. I once lost a $4,000 annual premium because I didn’t follow up with a referral within the first 48 hours — someone else got there first. That one stung for months.

Eventually a mentor pulled me aside and told me something that changed everything: “Your memory is not a business system.” He was right. The moment I started using a CRM built for insurance professionals, my retention rate went up, my closing ratio improved, and I stopped feeling like I was always one forgotten phone call away from losing a client.

Fast forward to 2026, and the insurance CRM market has grown significantly. There are platforms designed specifically for independent agents, large agencies, life insurance specialists, P&C brokers, and health insurance professionals. The challenge now isn’t finding a CRM — it’s finding the right one for how you actually sell and service policies.

I’ve spent the last month testing, researching, and comparing the CRM platforms that insurance professionals across the US are using right now. This guide covers everything I found.

What Makes an Insurance CRM Different from a Regular CRM?

This is the first question every agent asks, and it’s a fair one. Why can’t you just use Salesforce, HubSpot, or any general-purpose CRM and call it a day?

Technically, you can. Plenty of agents have tried. Most of them end up switching within a year because general CRMs don’t understand the insurance workflow.

Insurance is a relationship business with a very specific rhythm. You’re not just closing a one-time sale and moving on. You’re managing ongoing policies that renew annually. You’re tracking commission structures that vary by carrier, product, and policy year. You’re running through quoting processes that involve pulling rates from multiple carriers. And you’re dealing with compliance requirements that general CRMs have never heard of.

A proper insurance CRM handles all of this natively. It understands that a “deal” in your world is a policy with a start date, renewal date, premium amount, and commission schedule. It knows that your pipeline includes stages like “Quote Requested,” “Application Submitted,” “Underwriting,” and “Policy Issued.” It tracks beneficiaries, coverage types, and carrier information alongside basic contact details.

When you use a CRM that speaks your language, you spend less time configuring custom fields and workarounds and more time doing what actually generates revenue — talking to clients and writing policies.

Top 8 CRM Platforms for Insurance Agents in 2026

I ranked these based on how well they serve real insurance workflows — not just how well they market themselves. I looked at policy management features, commission tracking, carrier integrations, ease of use, pricing, and how well each platform supports both independent agents and growing agencies.

1. SMART ERP Suite

SMART ERP Suite earns the top spot for a reason most insurance-specific CRMs can’t match: it combines CRM functionality with full ERP capabilities, giving agents and agencies a single platform for client management, policy tracking, commission accounting, marketing automation, and financial reporting.

Think about what your business actually needs day to day. You’re managing client relationships, sure. But you’re also reconciling commissions from six different carriers. You’re tracking expenses. You’re sending renewal reminders and birthday emails. You’re generating reports for your E&O audit. Most insurance CRMs handle the first two and leave you scrambling for the rest.

SMART ERP Suite collapses that entire stack into one system. The CRM module lets you build custom pipelines for different insurance lines — one for life, one for P&C, one for group health. The accounting module tracks commissions by carrier, product type, and policy year so you always know exactly what you’re owed. The marketing automation sends renewal reminders, policy review requests, and referral asks on autopilot.

The built-in VoIP integration with softphone capability means your agents can call clients directly from the CRM, and every conversation gets logged automatically. For agencies with a call center component — whether that’s an inbound service line or an outbound sales team — this eliminates the need for a separate phone system.

Pricing reflects the all-in-one value, and when you factor in the tools it replaces, most agencies find it saves money compared to running three or four separate subscriptions. The 30-day free trial is long enough to import your book of business and see how it handles your actual workflow.

2. AgencyBloc

AgencyBloc was built from the ground up for life and health insurance agencies, and that focus shows in everything they do. The platform includes policy management, commission processing, automated workflows, and a CRM that’s organized around the way insurance agencies actually operate.

The commission module is one of the best I’ve seen in any insurance CRM. It imports commission statements from carriers, matches payments to policies, and flags discrepancies so you’re not manually reconciling spreadsheets every month. For agencies managing thousands of policies across dozens of carriers, this feature alone can save hours of administrative work each week.

AgencyBloc is particularly strong for group benefits agencies. The platform handles employer groups, enrollment tracking, and benefit plan management in a way that most general insurance CRMs simply don’t. Pricing is based on the number of policies managed rather than per-user, which can be more cost-effective for larger agencies.

3. Radiusbob

Radiusbob is a popular CRM among independent insurance agents, especially those selling life insurance, Medicare supplements, and final expense products. The platform focuses on lead management, communication tracking, and sales automation.

The built-in dialer is a big draw. Agents can load a list of leads and power through calls directly inside the CRM, with automatic call logging and disposition tracking. The email and text drip campaigns are easy to set up and run reliably, which matters when you’re nurturing leads that might take weeks or months to convert.

Pricing starts around $34 per month for a single user, making it one of the more affordable options. It’s a practical choice for solo agents who need solid lead management and follow-up automation without a lot of complexity.

4. HawkSoft

HawkSoft is a management system designed specifically for independent P&C insurance agencies. It combines CRM functionality with a full agency management system, including policy management, ACORD form generation, accounting, and carrier downloads.

What sets HawkSoft apart is the depth of its P&C-specific features. The system handles endorsements, claims tracking, renewal processing, and certificate management natively. If you’re running an independent P&C agency and need a system that understands the entire workflow from prospect to policy to claim, HawkSoft is purpose-built for that.

The platform has a loyal user base in the independent agent community, largely because of its responsive customer support and regular feature updates based on agent feedback. Pricing is competitive for the feature set, though you’ll need to contact them for a custom quote based on your agency size.

5. Insureio

Insureio targets life insurance agents and IMOs (Independent Marketing Organizations) with a platform that combines CRM, quoting, e-applications, and marketing automation. The multi-carrier quoting engine lets agents compare rates from dozens of life insurance carriers in minutes, which is a significant time saver during the sales process.

The CRM module tracks leads through a customizable pipeline, and the automated follow-up sequences are tailored for life insurance sales cycles. The e-application feature is a standout — agents can complete applications electronically within the platform, reducing paper processing time and improving the client experience.

Pricing starts around $25 per month for the basic plan, with higher tiers adding marketing automation and advanced quoting features. It’s a solid choice for life insurance specialists who want quoting and CRM in the same tool.

6. Salesforce Financial Services Cloud

Salesforce Financial Services Cloud brings the power of the Salesforce platform to insurance with industry-specific data models, workflows, and compliance features. It’s designed for larger agencies and insurance companies that need enterprise-grade customization and reporting.

The platform excels at modeling complex client relationships — households, businesses, beneficiaries, and their interconnections. The reporting and analytics capabilities are virtually limitless, and the AppExchange marketplace offers hundreds of insurance-specific add-ons.

The drawback is complexity and cost. Salesforce requires significant setup, ongoing administration, and typically a consultant to customize properly. Pricing starts around $300 per user per month, which puts it firmly in enterprise territory. For large agencies with dedicated IT resources, it’s a powerhouse. For independent agents, it’s probably more than you need.

7. Applied Epic

Applied Epic is one of the most widely used agency management systems in the P&C insurance industry. It’s a comprehensive platform that handles policy management, CRM, claims, accounting, and carrier connectivity for mid-size to large agencies and brokerages.

The carrier integration capabilities are extensive. Applied Epic connects with hundreds of insurance carriers for real-time policy downloads, premium billing, and claims data. The workflow automation tools help standardize processes across an agency, which becomes increasingly important as you add producers and service staff.

Applied Epic is a significant investment, both in licensing costs and implementation time. It’s best suited for established agencies with 10 or more employees that need a system capable of managing a complex operation. Smaller agencies might find the learning curve and cost prohibitive.

8. Zoho CRM (with Insurance Customization)

Zoho CRM is a general-purpose platform that can be customized for insurance workflows through custom modules, fields, and automation rules. It’s a practical option for agents who want a low-cost CRM and are willing to invest time in configuration.

The marketplace includes insurance-specific templates and extensions that shortcut the setup process. The email marketing, workflow automation, and reporting features are solid for the price point. Zoho also integrates with Zoho Books for accounting and Zoho Desk for client support, creating a lightweight business suite.

Pricing starts free for up to three users and goes up to $52 per user per month for the top tier. The catch is that you’re building an insurance CRM from a general-purpose tool, so you won’t get policy management, commission tracking, or carrier integration without add-ons or custom development.

Must-Have Features in an Insurance CRM

After working with insurance agents and agencies for over a decade, I’ve seen which CRM features actually move the needle and which ones just look good on a features page. Here are the ones that matter.

Policy and renewal tracking. Your CRM should store policy details — carrier, product type, premium, effective date, renewal date — and proactively alert you when renewals are approaching. The best systems trigger automated outreach 60 to 90 days before renewal, giving you time to schedule a policy review and lock in the retention.

Commission tracking and reconciliation. If you’re still tracking commissions in a spreadsheet, you know how painful it is. A good insurance CRM imports commission statements, matches them to policies, and tells you exactly what you’ve earned, what’s pending, and what’s overdue. This is table stakes for any serious agency.

Multi-line pipeline management. If you sell across multiple insurance lines — life, health, P&C, Medicare — you need a CRM that lets you create separate pipelines for each. The sales cycle for a term life policy looks nothing like the process for a commercial liability package, and your CRM should reflect that.

Automated follow-up and drip campaigns. Insurance sales are rarely one-call closes. Prospects need education, trust-building, and repeated touchpoints before they’re ready to move forward. Automated email and text sequences keep you in front of prospects without requiring you to manually send messages every day.

Built-in calling or VoIP integration. Insurance is still a phone-heavy business. Whether your CRM includes a native softphone or integrates with a VoIP provider, the ability to make calls from inside the platform and have them automatically logged saves time and improves data accuracy.

Document management. You’re dealing with applications, policy documents, ID cards, medical records, and signed forms constantly. Your CRM should let you attach documents to client records and access them quickly during conversations.

Compliance and audit trails. Depending on your state and the lines you write, you may need to demonstrate that certain disclosures were made, that needs analyses were completed, or that specific communications were sent. A CRM with strong activity logging gives you a defensible record if questions ever arise.

Best CRM by Insurance Type: Life, Health, and P&C

Not every CRM works equally well for every type of insurance. Here’s how I’d break down the recommendations based on what you sell.

Life insurance agents tend to be high-volume callers working through lead lists. Speed to contact and follow-up automation matter most. Radiusbob, Insureio, and SMART ERP Suite are strong choices. Insureio has the edge on multi-carrier quoting, while SMART ERP Suite wins on the all-in-one combination of CRM, calling, and accounting.

Health insurance and Medicare agents need enrollment tracking, plan comparison tools, and AEP/OEP campaign management. AgencyBloc is the standout here, especially for agencies managing group benefits. SMART ERP Suite also works well thanks to its flexible pipeline and automation tools.

P&C agents and brokers need deep carrier integration, ACORD forms, claims tracking, and certificate management. HawkSoft and Applied Epic were built specifically for this world. If you need a lighter solution that still covers the basics, SMART ERP Suite’s customizable modules can be configured for P&C workflows without the heavy implementation cost.

If you sell across multiple lines, an all-in-one platform like SMART ERP Suite gives you the flexibility to manage everything in one system rather than running separate CRMs for different product types.

Insurance CRM Pricing: What to Budget For

Pricing across the insurance CRM landscape varies considerably based on your agency size and needs.

Solo agents can get started for as little as $25 to $50 per month with platforms like Insureio, Radiusbob, or Zoho CRM. At this price point, you get basic contact management, pipeline tracking, and some automation. It’s enough to organize your business and stop relying on memory.

Growing agencies with 3 to 15 producers should budget between $100 and $300 per month total. Platforms like AgencyBloc, SMART ERP Suite, and HawkSoft fit this range and offer the policy management, commission tracking, and team features that agencies need as they scale.

Large agencies and brokerages typically invest $500 to $2,000 or more per month in platforms like Applied Epic, Salesforce Financial Services Cloud, or enterprise-level SMART ERP Suite deployments. The investment is justified by the operational efficiency gains and the depth of carrier integration and reporting these platforms provide.

The most important pricing advice I can give: calculate what you’re currently spending across all your tools. Most agents are paying separately for a CRM, an email marketing platform, a dialer, and an accounting tool. When you add those up, an all-in-one platform like SMART ERP Suite often costs less than the combined total while giving you a more integrated experience.

Final Thoughts: The CRM That Pays for Itself

I’ll leave you with a number that still sticks with me from my selling days. The average insurance agent loses 15 to 20 percent of their book of business every year to lapses, non-renewals, and competitors. That number drops to under 10 percent when agents use a CRM with automated renewal outreach and regular client touchpoints.

Do the math on your own book. If your annual commissions are $150,000 and you’re losing 18 percent to attrition, that’s $27,000 walking out the door every year. Cut that attrition in half with a proper CRM and automated retention campaigns, and you’ve just added $13,500 to your annual income. A CRM that costs $200 a month suddenly looks like the best investment you’ve ever made.

That’s before you factor in the new business side. Faster follow-up means more conversions. Better pipeline management means fewer leads falling through the cracks. Automated referral requests mean a steady stream of warm introductions without you having to remember to ask.

My top recommendation for insurance agents and agencies in 2026 is SMART ERP Suite. The combination of CRM, commission tracking, VoIP calling with built-in softphone, marketing automation, and financial reporting in a single platform addresses the full reality of running an insurance business. It’s not just a contact database — it’s an operating system for your agency.

Take the 30-day free trial, import a chunk of your client list, set up a renewal campaign, and see how it feels. I’m betting you’ll wonder why you waited so long to make the switch.