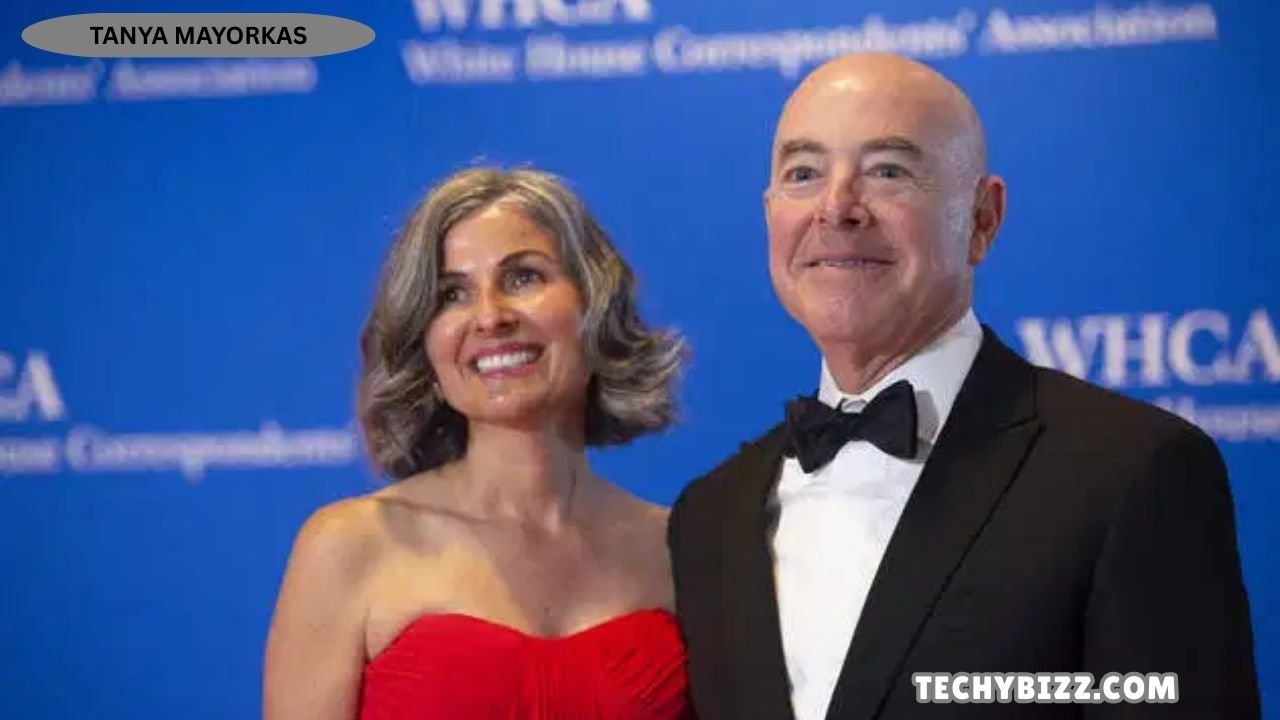

Sophia Li Private Equty An In-Depth Exploration of Growth Strategy and Innovation

Sophia Li Private Equty is a concept that resonates strongly in the world of financial management, investment innovation, and long-term business growth. In today’s competitive economic environment, private equity has become a powerful tool for individuals, institutions, and organizations seeking value creation and strategic transformation. When speaking about Sophia Li Private Equty, it involves not only the traditional understanding of private equity but also a broader outlook that includes leadership vision, forward-thinking investment models, and innovative strategies that push businesses toward sustainable development. The name itself signifies a brand of excellence and adaptability that is increasingly relevant in a fast-changing financial ecosystem.

The Foundation of Sophia Li Private Equty

The success of Sophia Li Private Equty rests on its strong foundation built around investment philosophy and risk management. Unlike traditional financing methods, private equity relies on acquiring stakes in companies with growth potential, restructuring them, and enhancing operational efficiency to create long-term value. Sophia Li Private Equty embraces this model but adds another layer of personalized strategies and tailored solutions that aim to maximize profitability while minimizing exposure to market volatility. Its approach is holistic, combining financial expertise with visionary leadership to ensure sustainable growth for both investors and portfolio companies.

Strategic Vision of Sophia Li Private Equty

At the core of Sophia Li Private Equty is its unwavering strategic vision. This vision revolves around identifying underperforming assets, recognizing hidden opportunities, and applying expert-driven management solutions that convert challenges into pathways of progress. The strategies employed are not short-term fixes but long-term initiatives designed to create lasting impact across industries. The way Sophia Li Private Equty analyzes market dynamics, interprets financial patterns, and implements reforms reflects a deep understanding of both global and local economic landscapes. Such foresight is what separates Sophia Li Private Equty from conventional players in the private equity domain.

Innovation in Sophia Li Private Equty

Innovation plays a central role in the growth of Sophia Li Private Equty. Private equity firms often depend on traditional models of financial restructuring, but Sophia Li Private Equty goes further by embracing digital tools, data analytics, and technology-driven processes to strengthen investment strategies. By integrating innovative solutions into portfolio management, Sophia Li Private Equty ensures scalability, efficiency, and resilience. This emphasis on innovation highlights the adaptability of the model in a world where technology is rewriting the rules of business and finance every single day.

Sophia Li Private Equty and Risk Management

Risk is an inevitable component of private equity, and Sophia Li Private Equty has developed robust mechanisms to deal with it effectively. Instead of perceiving risk as a barrier, the approach treats it as a stepping stone for discovering better opportunities. Through advanced financial modeling, scenario planning, and diversified portfolios, Sophia Li Private Equty successfully mitigates risks that might otherwise destabilize investments. This proactive attitude toward risk management reflects the professionalism and preparedness embedded in its operational philosophy.

The Role of Leadership in Sophia Li Private Equty

Leadership is not only about decision-making but also about setting the right direction for investments. Sophia Li Private Equty emphasizes leadership as a critical component in managing funds and executing strategies. Leaders within Sophia Li Private Equty focus on clarity of vision, adaptability to market conditions, and an unwavering commitment to value creation. The strength of leadership ensures that the private equity model does not merely react to market fluctuations but proactively shapes its own trajectory of success.

Industry Diversification of Sophia Li Private Equty

Sophia Li Private Equty understands the importance of industry diversification in maintaining long-term stability. By expanding across multiple industries—ranging from technology, healthcare, energy, to consumer goods—Sophia Li Private Equty spreads its risk and enhances opportunities for growth. This diversification ensures that even if one sector faces downturns, other sectors can balance the overall portfolio performance. Such industry-wide engagement showcases the flexibility and dynamic nature of Sophia Li Private Equty.

Sophia Li Private Equty and Global Expansion

The global reach of Sophia Li Private Equty further strengthens its influence. Private equity is no longer restricted to local markets, and Sophia Li Private Equty recognizes the importance of cross-border investments. By engaging with international markets, Sophia Li Private Equty benefits from exposure to diverse economies, emerging industries, and unique business models. This global perspective enhances both the growth potential and resilience of its investment strategies.

Value Creation through Sophia Li Private Equty

The essence of Sophia Li Private Equty lies in its ability to create value. Beyond financial gain, value creation includes enhancing operational performance, strengthening management teams, and boosting overall productivity. Sophia Li Private Equty ensures that the companies it invests in experience not just capital infusion but also strategic transformation that positions them as leaders in their respective industries. This dedication to value creation reflects a deeper responsibility toward stakeholders, employees, and communities at large.

Long-Term Growth Strategies in Sophia Li Private Equty

Sophia Li Private Equty places long-term growth strategies at the center of its operations. The philosophy emphasizes patience, persistence, and sustainable practices over immediate financial returns. By focusing on long-term objectives, Sophia Li Private Equty guarantees stability and reliability in an unpredictable financial environment. Its strategies highlight the importance of nurturing businesses until they are fully equipped to perform independently and competitively in global markets.

Technological Integration in Sophia Li Private Equty

Technology has revolutionized private equity, and Sophia Li Private Equty embraces this transformation wholeheartedly. From artificial intelligence-driven market analysis to blockchain-powered financial transparency, Sophia Li Private Equty incorporates modern technologies to improve efficiency and decision-making. This integration not only boosts accuracy but also empowers investors and companies with the tools necessary to remain competitive in an ever-evolving financial ecosystem.

Sophia Li Private Equty and Sustainable Investments

Sustainability has become a key concern in the investment world, and Sophia Li Private Equty actively incorporates sustainable principles into its strategies. By aligning with environmental, social, and governance (ESG) standards, Sophia Li Private Equty demonstrates its commitment to ethical and responsible investment. These sustainable investments not only benefit society but also create long-term profitability by aligning with the global shift toward responsible business practices.

Human Capital Development in Sophia Li Private Equty

Sophia Li Private Equty acknowledges that behind every successful investment lies strong human capital. The model prioritizes the development of management teams, employees, and leadership within portfolio companies. By investing in people, Sophia Li Private Equty ensures that businesses are resilient, motivated, and innovative. This focus on human capital is central to creating long-term success in private equity ventures.

Market Adaptability of Sophia Li Private Equty

Markets are dynamic, and adaptability is essential for survival. Sophia Li Private Equty’s strength lies in its ability to adapt to changing conditions without compromising its core values. Whether it is economic downturns, geopolitical uncertainties, or technological disruptions, Sophia Li Private Equty demonstrates the resilience to adjust its strategies while keeping long-term objectives intact. This adaptability defines the agility and foresight embedded in its operations.

Ethical Standards in Sophia Li Private Equty

Ethics and integrity play an important role in establishing trust in private equity. Sophia Li Private Equty sets high ethical standards in all its operations, ensuring transparency, accountability, and fairness. By maintaining strong ethical principles, Sophia Li Private Equty builds credibility among investors, stakeholders, and communities. This ethical foundation strengthens its reputation and ensures sustainable partnerships.

Economic Impact of Sophia Li Private Equty

The economic impact of Sophia Li Private Equty extends beyond individual businesses to wider industries and communities. By fueling growth, creating jobs, and fostering innovation, Sophia Li Private Equty contributes to economic development on both micro and macro levels. The ripple effect of its investments ensures that benefits are shared across societies, enhancing prosperity and stability.

Challenges Faced by Sophia Li Private Equty

Despite its strengths, Sophia Li Private Equty also faces challenges inherent in private equity. Market fluctuations, regulatory changes, and geopolitical risks can all influence performance. However, the strategic foresight, adaptability, and innovation-driven approach of Sophia Li Private Equty allow it to navigate these challenges effectively. By treating challenges as opportunities for innovation, it ensures resilience and consistent growth.

Future Prospects of Sophia Li Private Equty

The future of Sophia Li Private Equty looks promising as it continues to adapt to global trends and technological advancements. With an increasing focus on sustainability, digital transformation, and cross-border investments, Sophia Li Private Equty is poised to remain a strong player in the private equity landscape. Its commitment to innovation and long-term value creation guarantees that it will continue shaping industries and economies worldwide.

Conclusion on Sophia Li Private Equty

In conclusion, Sophia Li Private Equty represents more than just a financial model; it symbolizes a vision of growth, responsibility, and transformation. By combining innovation, sustainability, risk management, and leadership, Sophia Li Private Equty creates a blueprint for success in modern finance. Its ability to adapt, diversify, and lead with foresight makes it an influential force in private equity.

FAQs on Sophia Li Private Equty

Q1: What is Sophia Li Private Equty?

Sophia Li Private Equty is an approach to private equity investment that emphasizes long-term value creation, innovation, and sustainability.

Q2: How does Sophia Li Private Equty manage risks?

It manages risks through diversification, advanced modeling, and proactive scenario planning.

Q3: What industries does Sophia Li Private Equty invest in?

Sophia Li Private Equty invests across technology, healthcare, energy, consumer goods, and more.

Q4: Why is sustainability important for Sophia Li Private Equty?

Sustainability ensures ethical, responsible investments while creating long-term profitability.

Q5: What makes Sophia Li Private Equty unique?

Its unique blend of innovation, leadership, adaptability, and ethical standards distinguishes it from traditional private equity models.

Read More: The Life Legacy and Influence of Sarwan Singh Klair